Fixed Rate Mortgage

A rate that won't change for a specified period of time. The benefit of a fixed rate mortgage is that you will not be affected by rising or falling interest rates during your fixed term.

Fixed 2 years

| LTV | Initial Fixed Rate | Follow On Rate | APRC | Early Repayment Fee/Charges |

|---|---|---|---|---|

| Up to 70% | 4.85% | Base rate +2.90% | 7.60% | 2% in the first year, 1% in the second |

| 70 - 85% | 5.35% | Base rate +3.10% | 7.80% |

Representative Example – 2-year fixed rate

An amortised mortgage of £250,000 payable over a term of 25 years initially on a rate of 4.95% for 2 years and then our variable rate of 7.90% for the remaining 23 years would require 24 monthly payments of £1,476.08 and 276 payments of £1,916.43. An arrangement fee of £999 is also payable as well as valuation fee of £570 and legal fees of £1,250. The total amount payable would be £571,679.60 made up of the loan amount plus interest of £321,679.60..

Notes: Subject to eligibility and terms and conditions. Rates and charges are correct as at January 14th 2025 and are subject to change. Figures are indicative and not a commitment to lend and rates may vary based on individual circumstances and changes to the UK Base Rate. Please consult a Mortgage Planner for further information on our products.

Fixed 3 years

| LTV | Initial Fixed Rate | Follow On Rate | APRC | Early Repayment Fee/Charges |

|---|---|---|---|---|

| Up to 70% | 4.75% | Base rate +2.90% | 7.40% | 3% reducing 1% per year |

| 70 - 85% | 5.25% | Base rate +3.10% | 7.60% |

Representative Example – 3-year fixed rate

An amortised mortgage of £250,000 payable over a term of 25 years initially on a rate of 4.80% for 3 years and then our variable rate of 7.90% for the remaining 22 years would require 36 monthly payments of £1,432.49 and 264 payments of £1,865.85. An arrangement fee of £999 is also payable as well as valuation fee of £570 and legal fees of £1,250. The total amount payable would be £551,473.04 made up of the loan amount plus interest of £301,473.04..

Notes: Subject to eligibility and terms and conditions. Rates and charges are correct as at January 14th 2025 and are subject to change. Figures are indicative and not a commitment to lend and rates may vary based on individual circumstances and changes to the UK Base Rate. Please consult a Mortgage Planner for further information on our products.

Fixed 5 years

| LTV | Initial Fixed Rate | Follow On Rate | APRC | Early Repayment Fee/Charges |

|---|---|---|---|---|

| Up to 70% | 4.60% | Base rate +2.9% | 6.70% | 5% reducing by 1% per year |

| 70 - 85% | 5.10% | Base rate +3.1% | 7.10% |

Representative Example – 5-year fixed rate

An amortised mortgage of £250,000 payable over a term of 25 years initially on a rate of 5.10% for 3 years and then our variable rate of 7.10% for the remaining years. With an initial payment of £1,476.08. An arrangement fee of £999 is also payable as well as valuation fee of £570 and legal fees of £1,250. The total amount payable would be £536,185.40 made up of the loan amount plus interest of £286,185.40.

Notes: Subject to eligibility and terms and conditions. Rates and charges are correct as at January 14th 2025 and are subject to change. Figures are indicative and not a commitment to lend and rates may vary based on individual circumstances and changes to the UK Base Rate. Please consult a Mortgage Planner for further information on our products.

We will contact you prior to the end of the fixed rate period, to allow you enough time to decide how to proceed and inform you of your options going forward.

To Consider

In addition to the costs, you will also be responsible for the Bank's legal costs, which will depend on the mortgage amount. A written estimate of the Bank's legal costs will be made available to you upon request and when your loan application is agreed. You should also bear in mind that you will have your own legal costs and expenses (e.g. taxes) to meet in respect of your purchase of the property. Please contact us for more information.

Suitable property insurance will be a condition of the mortgage, but is not arranged by the Bank and is your sole responsibility. Whilst we do not usually make life insurance a condition of the mortgage, you should consider if you would like to arrange cover to repay the loan in the event of death or loss of income from illness. There are various types of life cover available, and you should take your own independent advice in this regard.

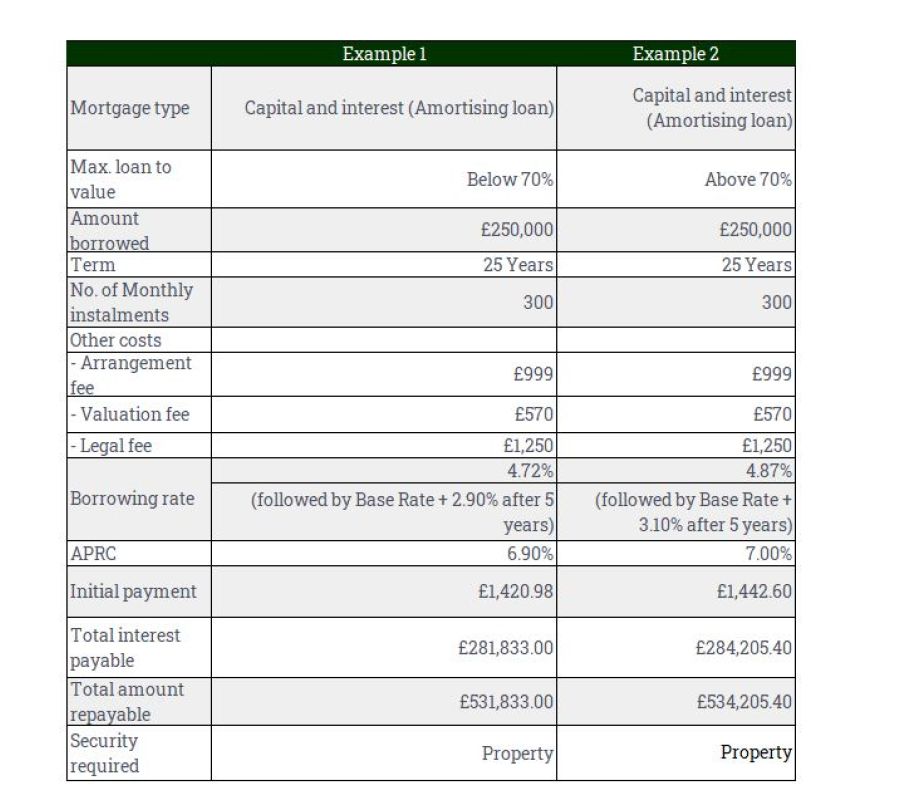

Here is an illustrative example of 5 year fixed rate offered by Trusted Novus Bank.

Please note that the follow on rate (After the Fixed rate period) is subject to change in line with Bank of England base rate.

5 year mortgage examples

Times are changing

We have seen significant rises in interest rates in recent months. This has increased the cost of most mortgages. Alongside a rise in fuel, food and services, we are seeing an increased burden on the general cost of living.

You might also be interested in

Payment Difficulties

Ability to repay

Your home or property may be repossessed if you do not keep up repayments on your mortgage.