We offer a professional and personal service with entry levels lower than you would expect.

We specialise in serving Gibraltar residents as well as International clients living abroad who are seeking a secure third party jurisdiction. Our minimum level for Gibraltar residents is £250k and £500k (or currency equivalent) for International clients.

Your dedicated Relationship Manager will:

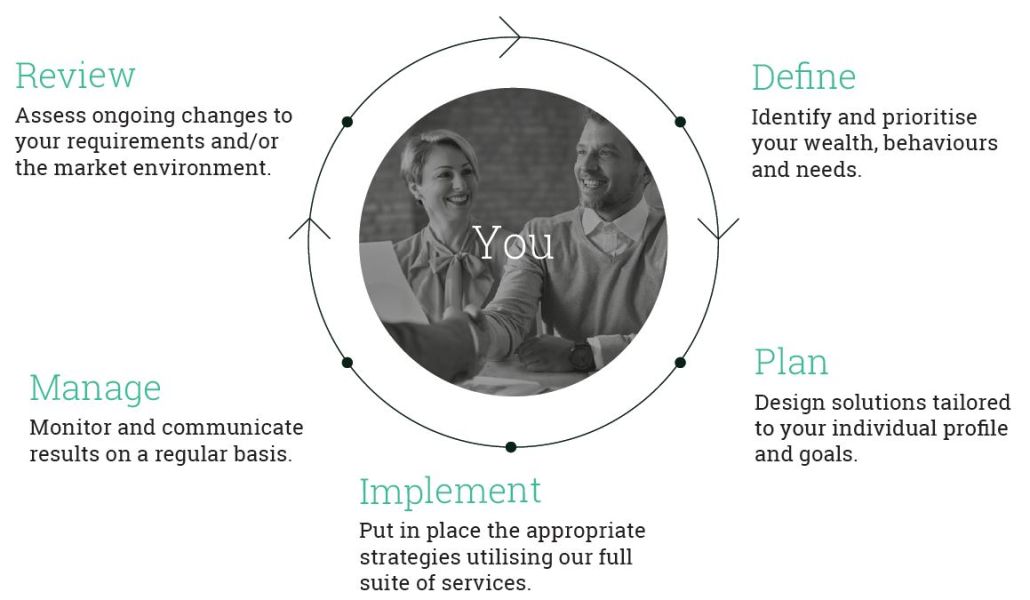

Our dynamic client-centred process

Investments

We offer you a choice of investment services and solutions tailored to your financial goals, level of experience and desired involvement.

We offer the following services:

- Discretionary Portfolio Management.

- Advisory Investment Service.

- Execution Only Service.

Lombard Loans

In the right circumstances, borrowing against the value of your liquid assets can offer a fast, flexible solution to meeting your cash flow needs.

Mortgages

Whether you're buying your dream home, remortgaging your current property, borrowing more, or buying an investment property, we can help. Available for Gibraltar and UK properties.

Cards

You can have credit or debit cards issued in GBP, EUR and USD and increase your spending limit within minutes with just a phonecall.

Deposits

Multi-currency deposits. We offer current accounts and fixed deposits in all major currencies. Our fixed term deposits range from one month to three years.

Your case is unique, every time.There is no “one-size-fits-all” when it comes to investments. Even though we present a diverse range of robust investment solutions on this web page, there is no guarantee that any one of them is appropriate and suitable for your specific needs and objectives. We recommend that any investment decision is based on professional, individual advice, and we are happy to provide exactly that.