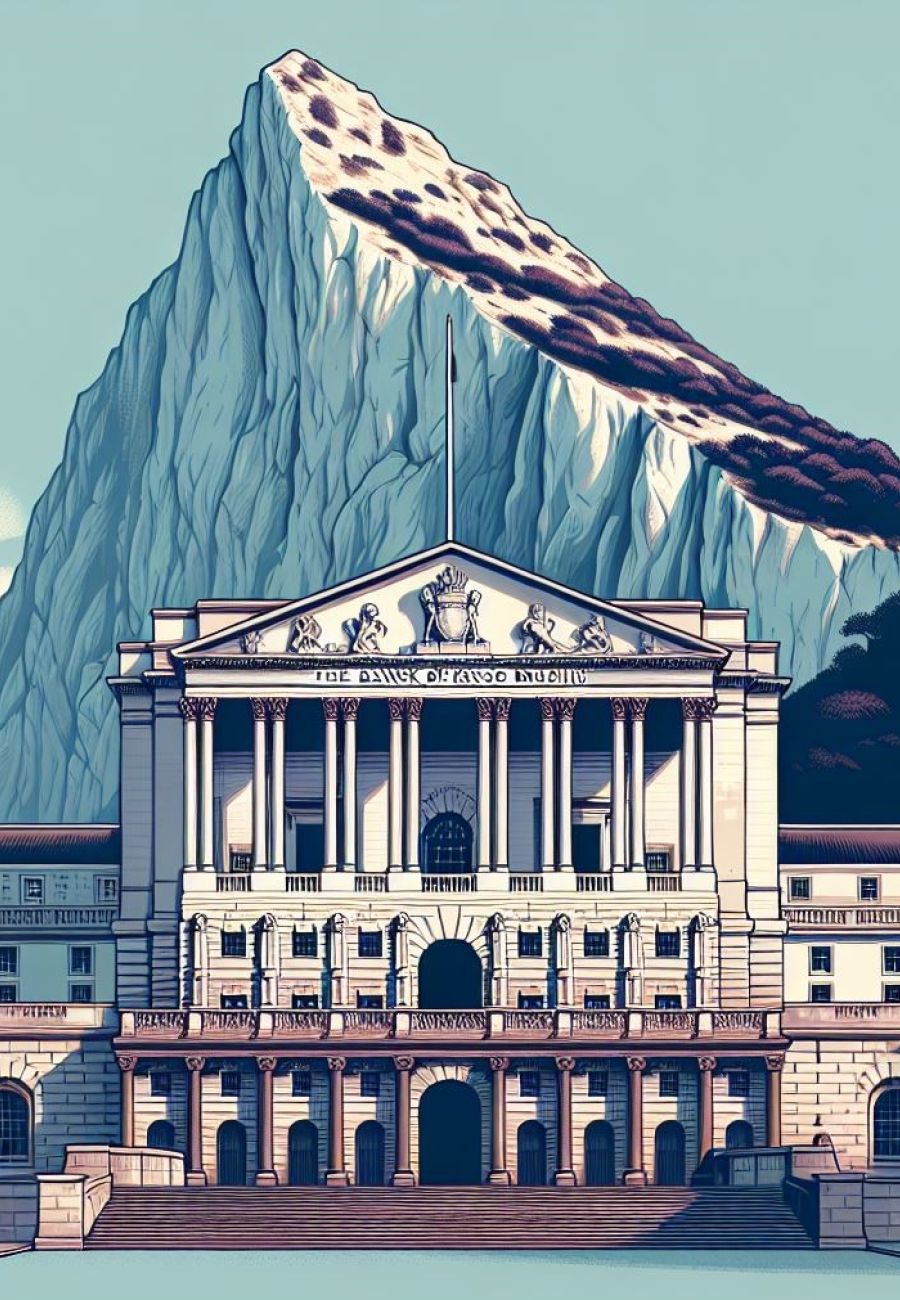

Bank of England’s rate cut, and what Gibraltar’s savers can do next

The latest Bank of England rate cut will be welcome news for those with loans and mortgages. However, for those with large cash savings who have been enjoying higher deposit rates in recent years, the time may have come to look for higher returning assets. For those who have the right time horizon and risk appetite, investing in a well-diversified portfolio of stocks and bonds can be a compelling alternative in this scenario.

Why invest in markets?

Portfolios of stocks and bonds have historically provided higher returns compared to fixed deposits. While they come with higher risk, the potential for capital appreciation and dividends can significantly boost your overall savings pot. A well-diversified portfolio spreads investments across various sectors, industries, and countries. This diversification reduces the impact of poor performance in any single investment, thereby managing risk more effectively. The geographical diversification that a portfolio can offer could also benefit those who may have a high concentration of assets in one country. For example, you may have a bank account, debentures and one or more properties in Gibraltar – these are all exposed to the same jurisdictional risk.

Stocks can also act as a hedge against inflation. As companies increase prices to keep up with inflation, their revenues and profits can grow, potentially leading to higher stock prices. This helps preserve the purchasing power of your investments.

Highly rated bonds generally offer better certainty than stocks, and they are an important building block to consider when constructing a diversified portfolio. Bonds offer the opportunity to lock in a fixed rate for a longer period than a fixed term deposit so for those looking for longer term certainty a bond portfolio could be a good option.

These investments can also be more liquid than fixed deposits. You can buy and sell them relatively quickly, giving you greater flexibility to respond to your personal financial needs. Investing in the market this way allows you to participate in the growth of companies and the economy. We can also offer back-to-back loans against the value of your portfolio which allow you to access liquidity without having to sell your holdings.

While investing involves higher risk compared to fixed deposits, the potential for higher long-term returns, diversification benefits, and other advantages make it a viable option when rates are falling.

Getting started doesn’t need to be difficult or complicated. A professional adviser will always consider your risk tolerance, investment horizon, and financial goals when making investment decisions on your behalf.

TNB’s own team of dedicated Relationship Managers are here to answer any questions and walk you through the process. We offer a range of investment solutions that can suit your individual level of knowledge and interest from the “do-it-for-me” approach of our Discretionary Portfolios, the “do-it-with-me” option of an Advisory Service and the full DIY offer via our execution only capability.

If you are interested to learn more, or have any specific questions, book a no-obligation appointment with a Relationship Manager to get you started.

There is no “one-size-fits-all” when it comes to investments, past performance does not guarantee future results and the value of investments can fall as well as rise. Even though there is reference to a diverse range of investment solutions in this article, there is no guarantee that any one of them is appropriate and suitable for your specific needs and objectives. We recommend that any investment decision is based on professional, individual advice.