Gearing and Investment Guidelines

These guidelines contain the Trusted Novus Bank Limited (the Bank) rules applicable to the gearing and investment of assets placed as collateral for lending Facilities with the Bank.

The Bank lends against the collateral value (CV) of liquid assets which is a percentage of the market value. The Bank operates on the principle that the combined CV of any assets held must at all times be equal to or greater than the drawn credit facilities (the Facility), to ensure that at all times the Facility is secured by the CV of the assets held. CVs are determined according to the risk associated with an asset. In general terms the higher the risk associated with an asset, the lower its CV for the purpose of borrowing.

Your capital can be at risk with a Lombard Facility. The worst-case scenario is that you will lose your entire investment and be obliged to cover any losses towards the Bank, which could exceed your original investment

As different types of assets involve different types of risk (explained below) the Bank applies different CVs for different asset types. In addition, specific rules apply to ratings, the breakdown of diversification of investments by amount and sectors, as well as market liquidity. The overall CV granted to an asset for the purpose of lending takes these factors into account.

Requirement to hold full cover for utilised credit facilities

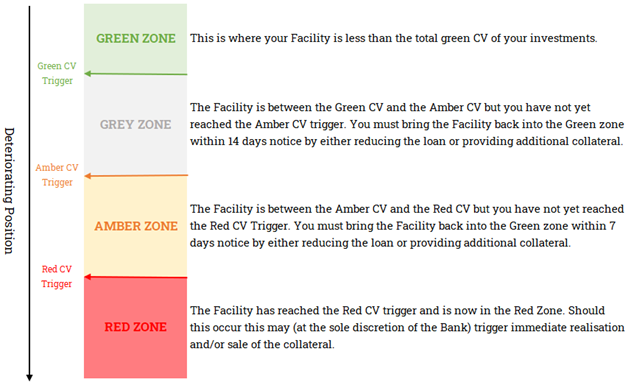

Your Facility should be fully covered by the CV of your liquid assets held with the Bank. Whether due to fall in market value of the assets causing the CV to reduce or the value of Facility increasing relative to the CV (e.g. if you borrow in a different currency than your investments), your Facility should be fully covered by the CV. The Bank will monitor this by applying Green, Amber and Red CV trigger points to your investments, which will determine the action that needs to be taken to ensure the loan is fully covered at all times, as explained below:

Where your Facility falls within the Grey or Amber zone and is not brought back within the Green Zone within the required notice period, or where the Facility has moved into the Red Zone, the Bank will be entitled (without notice or consent) to take action to sell all or part of the collateral provided

Where the Bank assesses that immediate sale is required to avoid or limit a loss, the said periods of notice may notwithstanding the above provisions be dispensed with.

Example

The table below demonstrates how a change in market value will reduce the collateral values of the assets pledged as security and shows how this may affect your Facility.

In Scenario 1, the market value of the assets is £850,000. The Facility of £550,000 is less than the Green CV and within the GREEN ZONE. No further action is required.

In Scenario 2 market values have fallen by 10% and the market value is now £765,000. The Facility of £550,000 is higher than the Green CV but less than the £612,000 Amber CV and therefore within the GREY ZONE.

Action is now required within 14 days to bring the facility back in line with the Green Zone.

In Scenario 3 market values have fallen by 20% and the market value is now £637,500. The Facility of £550,000 is higher than the Amber CV but less than the £573,750 Red CV and therefore within the AMBER ZONE.

Action is now required within 7 days to bring the facility back in line with the Green Zone.

In Scenario 4 market values have fallen by 25% and the market value is now £595,000. The Facility of £550,000 is higher the Red CV of £535,500 and the Facility is therefore within the RED ZONE.

This may trigger immediate realisation and/or sale of the collateral, which the Bank is entitled (but not obliged) to do without notice and without your consent.

Please note that the above example is based on the CV assigned to Equities, however the CV assigned will vary depending on the specifications of the asset pledged as security. The CV that can be assigned to each asset class and the specifications for these are set out below.

Collateral Values Assigned to Different Asset Types |

|||

|

Asset class |

Green CV % of asset market value |

Amber CV % of asset market value |

Red CV % of asset market value |

|

Cash balance Note 1) |

100 |

100 |

100 |

|

Bonds Note 2) |

85 |

90 |

95 |

|

Equities incl. convertible bonds Note 3) |

70 |

80 |

90 |

|

Corporate bonds Note 4) |

CV similar to that of a Bond or Equity depending on current rating. |

||

|

Emerging Market securities Note 5) |

50 |

70 |

90 |

|

Mutual fund units Note 6) |

Will be determined separately on the basis of the fund risk profile. |

||

|

Structured products Note 7) |

Will be determined separately on the basis of the product risk profile. |

||

Currency risk

A reduction to the CV of an asset will be applied when the currency in which the asset/investment is denominated differs from that in which the Facility is drawn in order to allow for currency risk due to fluctuating Foreign Exchange rates.

The level of reduction applied is dependent upon the currency rating and the asset/Facility currency mix but would typically be between 0% and 10%. The CV of assets denominated in a currency with an official currency rating of less than BBB-/Baa3 would be reduced to zero.

IMPORTANT - The Bank only monitors the collateral value of assets provided as security for the purposes of the Bank’s own internal collateral risk assessment purposes and not for your benefit. No reliance should be placed on any values attributed by the Bank.

|

Re 1) - Cash balance |

The official currency rating must be at least BBB-/Baa3 as stated by the international rating agencies Standard & Poor’s and Moody’s.

Diversification requirements – currency risk: If the account base currency is rated lower than A/A3 by the two rating agencies, the balance in said currency shall not exceed the investor’s equity capital (please see definition of ‘equity’ in the Glossary. |

|

Re 2) - Bonds |

Diversification requirement – credit risk: If the bond issue is rated higher or equal to A-/A3 by the international rating agencies Standard & Poor’s or Moody’s, the credit risk on the bond issuer need not be diversified. In other words, the total amount may be invested in a single bond. If, on the other hand, the bond issuer is rated below A-/A3, an investment in this particular issue shall not account for more than the equity capital invested (Net Asset Value).

Diversification requirements – currency risk: If the above-mentioned bond issue is denominated in a currency (based on country rating) which is rated lower than A-/A3 but higher than BB+/Ba1 by the two rating agencies, it shall not account for more than the equity capital. |

|

Re 3) - Shares incl. convertible bonds |

B-/ B3 Credit Rating is the minimum rating in order for shares to be granted a CV. In the event of a conflict the composite value should be used.

Diversification requirement – credit risk: For a Facility backed by shares only, these shares must be spread over at least 6 different companies and at least 3 sectors.

In addition, no single equity investment shall account for more than 50% of the equity capital at the time of purchase.

Rating: The rating of the country in which the company that issued the shares is domiciled must be at least BBB-/Baa3.

Market liquidity: A company’s market capitalisation must be at least DKK 500m/EUR 70m, and the shares must be listed on a recognised stock exchange. In addition, the share must be liquid at the time of purchase. The Bank decides whether a share is deemed liquid at the time of investment.

A Nil CV shall be applied to emerging market stocks, American Depositary Receipts (ADR) and Global Depositary Receipts (GDR) |

|

Re 4) - Corporate bonds |

Corporate bonds rated at least BBB-/Baa3 are treated as bonds, cf. Re 2) – Bonds, above. and will therefore receive the highest CV Corporate bonds rated BB+/Ba1 or lower are treated as equities, cf. Re 3) – Shares, above.

Market liquidity: A company’s market capitalisation must be at least DKK 500m/EUR 70m, and the shares must be listed on a recognised stock exchange. |

|

Re 5) - Emerging Market securities |

Exposure to Emerging Markets (hereafter EM) is generally associated with high risk. The group of EM countries consists of countries with ratings from B+/B1 to BB+/Ba1.

EM countries and/or EM currency assets will be geared based on the principles of share investments, cf. the rules stated in Re 3) - Shares above.

The maximum exposure to an EM country and/or EM currency can amount to 50% of the equity, and if a client wants exposure to two or more EM countries and/or EM currencies, these cannot in combination exceed 100% of the equity, still providing that an individual country/currency does not exceed 50% of the equity.

In other words: One EM country and/or EM currency = one “share” = max 50% of equity All EM countries and/or EM currencies = one sector = max 100% of equity

PLEASE NOTE: Individual shares and individual corporate bonds cannot be geared; however, we grant credit facilities on the basis of investment funds investing in individual shares and corporate bonds in EM countries. |

|

Re 6) – Mutual funds |

Mutual funds must comply with the UCITS rules or must be non-geared open-ended funds subject to daily pricing.

The CV of a given fund issued by a mutual fund is determined by the Bank on the basis of the investments made by the fund as set out in the fund’s articles of association. Thus, current fund investments do not determine the CV.

Diversification: Mutual fund investments are typically spread over a large number of issuers and are thus not subject to any specific requirements in this regard. One exception, however, is emerging market funds which according to the articles of association invest in a single country. The total investment of such a fund shall not account for more than 50% of the equity capital at the time of purchase.

Exchange Traded Funds (ETF): CV can be extended against ETFs in line with the guidelines provided that underlying securities are purchased (and not replicated on a synthetic basis). |

|

Re 7 – Structured products |

CV and conditions are determined by the Bank on the basis of an evaluation of the actual product, including the assets invested in and other risk factors. |

|

|

Credit quality – long-term debt |

|||

|

S & P |

Moody’s |

Rating |

Comments |

|

|

AAA |

Aaa |

Highest quality |

Minimal risk |

|

|

AA+ AA AA- |

Aa1 Aa2 Aa3 |

Very high quality |

Issuers in this category are all of good quality. The difference between AAA and Aaa is that it is considered slightly more uncertain whether a change in fundamental conditions will adversely affect the good quality. |

|

|

A+ A A- |

A1 A2 A3 |

High quality |

Well-established issuers of good to medium quality. Adequate debt servicing ability. Low risk that future economic changes may adversely affect debt servicing ability. |

|

|

BBB+ BBB BBB- |

Baa1 Baa2 Baa3 |

Good credit quality |

Issue of medium quality. Adequate debt servicing ability. Future changes may possibly have an adverse effect on debt servicing ability. Speculative elements. |

|

|

BB+ BB BB- |

Ba1 Ba2 Ba3 |

Speculative |

Speculative elements. There is a risk that the issuer will be unable to fulfil its debt servicing obligation. |

|

|

B+ B B- |

B1 B2 B3 |

Highly speculative |

Many speculative elements. There is a considerable risk that the issuer will be unable to meet its debt servicing ability. |

|

|

CCC+ CCC CCC- CC C |

Caa1 Caa2 Caa3 Ca C |

High risk of default |

Poor quality. Considerable speculative elements. Very negative outlook. |

|

|

D |

Suspension of payments |

|||

|

S & P Moody’s |

= Standard & Poor’s: Further information: www.standardandpoors.com = Moody’s Investors Service: Further information: www.moodys.com |

|||

|

CV |

The proportion of the market value of an asset expressed as a percentage or an amount, on which the Bank is willing to grant a Facility. Example: Where the market value of an asset of 100 has been assigned a CV of 85% by the Bank, the Bank may lend 85% against collateral of the asset in question. |

|

Equity capital |

Equity is the difference between the market value of an asset and the outstanding Facility for which the asset has been placed as security. Example: If the asset market value is 100 and the value of the outstanding Facility is -85, the equity is 15. |

|

Emerging Markets |

In broad terms, an emerging market country is a country making an effort to change and improve its economy in an attempt to bring it to the level of that of more prosperous nations. An investment in securities issued by emerging market countries or by companies domiciled in an emerging market economy is highly risky. The high level of risk is a result of the fact that emerging markets are at stage of development which may lead to unexpected political and economic events. The value of emerging market equities, bonds and currencies is therefore subject to considerable and sudden fluctuations. |

|

Facility |

In the context of this document, a Facility shall mean any current or potential liability (or part thereof) that the client has or will assume in relation to the Bank, including the client’s liabilities in respect of: · loans granted by the Bank · credit facilities made available by the Bank · bank guarantees provided by the Bank on behalf of the client · a potential payment obligation secured by the pledging of a client’s securities in safe custody |

|

Convertible bonds |

A convertible bond may be one of two things: · proof that you have lent a company a certain sum of money on which you regularly receive interest · a right, but not an obligation, to redeem the bond on a certain future date in return for a pre-defined number of shares in the company |

|

Open-ended |

An open-ended mutual fund sells fund units on a continuous basis and buys units whenever an investor wishes to sell units. The majority of mutual funds are open-ended funds. |

|

Rating |

Rating means grading or marking. In this document rating is used to denote the marking of the creditworthiness of a given security, currency and/or country. The “marks” referred to in this document are those of the two large and well-recognised international credit rating agencies Standard & Poor’s and Moody’s Investors Service. |

|

Rebalancing |

An investment portfolio is rebalanced in order to re-establish the balance in the investment portfolio so the same distribution of assets that originally applied is achieved in order to meet the diversification requirement. |

|

Structured products |

Structured products are financial products designed, for instance, to ensure the repayment to the investor of the investor’s original investment if he/she keeps the investment until the date of expiry, while at the same time offering participation in the increase of a particular equity index or currency. However, investors still assume the risk linked to those who guaranteed the issue. There are many types of structured products with varying qualities, and accordingly the Bank assigns each product a specific CV based on a thorough assessment of the risk associated with each product. |

|

UCITS |

Undertakings for Collective Investment in Transferable Securities. This particular EU directive regulates the operations of mutual funds. |

Although Lombard facilities can allow you to gear (leverage) your investment, improve returns and diversify your portfolio, please note that this strategy is not suitable for everyone. Your capital can be at risk with a Lombard Facility.

No investments are risk-free and where the collateral value of your investment falls, this can require action on your part to restore collateral value to an acceptable level if the collateral value is no longer sufficient to cover your drawn credit facility. Consequently, you must be financially capable of and prepared to accept fluctuations and potentially losses.

In providing Lombard facilities, Trusted Novus Bank will reserve the right - as a last resort – to realise sufficient investments to close the position and redeem the loan in full or in part. The worst-case scenario is that you will lose your entire investment and be obliged to cover any losses towards the Bank, which could exceed your original investment.

For this reason, it is important that you have the necessary insight to be able to judge the risk of the investment and the consequences of a fall in the value of your investments. In addition, your net income and net asset situation should be of such nature that considerable losses during the investment period does not have any severe impact on your private economy and should be relative to your net income and net assets.

Several factors may affect your geared investment - positively as well as negatively. Past performance is no indicator of future performance. The nature and extent of risks varies between countries and from investment to investment.

The generic risks are set out below:

|

Asset Fluctuation |

Fluctuations in the prices of individual assets, which can occur for a number of reasons. |

|

The Gearing Factor |

The higher the gearing, the wider the fluctuations which can occur. |

|

Economic Risk |

This is the risk that an investment will be affected by macroeconomic conditions including government regulation, exchange rates or political stability |

|

Market Liquidity Risk |

As liquidity is dependent on supply and demand, factors which affect either of these can restrict the ability to sell assets |

|

Credit Risk |

Investments in debt paper (e.g. Bond) issued by emerging market government or companies tend to entail higher levels of risk than established market debt |

|

Political Risk |

Political instability can impact a nation’s economy and politics and can cause fluctuations in assets values and in some cases, you may lose your rights in respect of assets you hold or in a worst-case scenario confiscation |

|

Foreign Exchange Risk |

Foreign exchange risk arises due to fluctuations between currencies and can arise between:

|

|

Interest Rate Risk |

A risk exists with interest rates that the relative value of a security, especially bonds, will deteriorate due to an interest rate increase. |